回测智能定投收益

新手指导

| 收益率 | 298.32% | 年化收益率  | 63.29% | 绝对收益 | 市值 | 425959.72 | 本金 | 106939.35 | 最大回撤 | 47.08% |

|---|

申赎记录

| 时间 | 份额 | 金额[1] | 计划 |

|---|---|---|---|

| 2016-05-23 | 460.67 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2016-05-09 | 466.04 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2016-04-25 | 447.76 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2016-04-11 | 177.48 | 499.25 | 普通 |

| 2016-03-28 | 435.87 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2016-03-14 | 569.92 | 1497.75 | -30%<(指数-均线)/指数<-20% |

| 2016-02-29 | 809.49 | 1997.00 | -40%<(指数-均线)/指数<-30% |

| 2016-02-15 | 571.22 | 1497.75 | -30%<(指数-均线)/指数<-20% |

| 2016-01-28 | 800.4 | 1997.00 | -40%<(指数-均线)/指数<-30% |

| 2016-01-14 | 439.38 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2015-12-31 | 151.79 | 499.25 | 普通 |

| 2015-12-17 | 148.99 | 499.25 | 普通 |

| 2015-12-03 | 151.61 | 499.25 | 普通 |

| 2015-11-19 | 148.23 | 499.25 | 普通 |

| 2015-11-05 | 160.53 | 499.25 | 普通 |

| 2015-10-22 | 164.39 | 499.25 | 普通 |

| 2015-10-08 | 185.66 | 499.25 | 普通 |

| 2015-09-23 | 192.46 | 499.25 | 普通 |

| 2015-09-09 | 197.25 | 499.25 | 普通 |

| 2015-08-26 | 213.08 | 499.25 | 普通 |

| 2015-08-12 | 163.05 | 499.25 | 普通 |

| 2015-07-29 | 163.96 | 499.25 | 普通 |

| 2015-07-15 | 174.99 | 499.25 | 普通 |

| 2015-07-01 | 149.16 | 499.25 | 普通 |

| 2015-06-17 | -8052.89 | -35078.40 | 市盈率>60,卖出 |

| 2015-06-03 | -80528.93 | -369144.61 | 市盈率>60,卖出 |

| 2015-05-20 | 120.3 | 499.25 | 普通 |

| 2015-05-06 | 151.1 | 499.25 | 普通 |

| 2015-04-22 | 168.78 | 499.25 | 普通 |

| 2015-04-08 | 174.14 | 499.25 | 普通 |

| 2015-03-25 | 174.5 | 499.25 | 普通 |

| 2015-03-11 | 211.73 | 499.25 | 普通 |

| 2015-02-25 | 224.99 | 499.25 | 普通 |

| 2015-02-11 | 244.01 | 499.25 | 普通 |

| 2015-01-28 | 268.27 | 499.25 | 普通 |

| 2015-01-14 | 295.76 | 499.25 | 普通 |

| 2014-12-31 | 316.98 | 499.25 | 普通 |

| 2014-12-17 | 287.59 | 499.25 | 普通 |

| 2014-12-03 | 283.99 | 499.25 | 普通 |

| 2014-11-19 | 293.5 | 499.25 | 普通 |

| 2014-11-05 | 297.53 | 499.25 | 普通 |

| 2014-10-22 | 305.91 | 499.25 | 普通 |

| 2014-10-08 | 297 | 499.25 | 普通 |

| 2014-09-23 | 308.37 | 499.25 | 普通 |

| 2014-09-09 | 312.03 | 499.25 | 普通 |

| 2014-08-26 | 338.93 | 499.25 | 普通 |

| 2014-08-12 | 346.22 | 499.25 | 普通 |

| 2014-07-29 | 353.33 | 499.25 | 普通 |

| 2014-07-15 | 353.58 | 499.25 | 普通 |

| 2014-07-01 | 352.58 | 499.25 | 普通 |

| 2014-06-17 | 371.74 | 499.25 | 普通 |

| 2014-06-03 | 380.82 | 499.25 | 普通 |

| 2014-05-20 | 394.66 | 499.25 | 普通 |

| 2014-05-06 | 383.74 | 499.25 | 普通 |

| 2014-04-22 | 367.91 | 499.25 | 普通 |

| 2014-04-08 | 369.81 | 499.25 | 普通 |

| 2014-03-25 | 370.09 | 499.25 | 普通 |

| 2014-03-11 | 368.72 | 499.25 | 普通 |

| 2014-02-25 | 372.3 | 499.25 | 普通 |

| 2014-02-11 | 367.91 | 499.25 | 普通 |

| 2014-01-28 | 384.63 | 499.25 | 普通 |

| 2014-01-14 | 402.62 | 499.25 | 普通 |

| 2013-12-31 | 405.56 | 499.25 | 普通 |

| 2013-12-17 | 410.57 | 499.25 | 普通 |

| 2013-12-03 | 405.89 | 499.25 | 普通 |

| 2013-11-19 | 397.81 | 499.25 | 普通 |

| 2013-11-05 | 395.6 | 499.25 | 普通 |

| 2013-10-22 | 310.67 | 499.25 | 普通 |

| 2013-10-08 | 307.8 | 499.25 | 普通 |

| 2013-09-23 | 314.39 | 499.25 | 普通 |

| 2013-09-05 | 323.56 | 499.25 | 普通 |

| 2013-08-22 | 335.29 | 499.25 | 普通 |

| 2013-08-08 | 332.83 | 499.25 | 普通 |

| 2013-07-25 | 346.94 | 499.25 | 普通 |

| 2013-07-11 | 346.94 | 499.25 | 普通 |

| 2013-06-27 | 381.11 | 499.25 | 普通 |

| 2013-06-13 | 384.93 | 499.25 | 普通 |

| 2013-05-30 | 359.69 | 499.25 | 普通 |

| 2013-05-16 | 375.66 | 499.25 | 普通 |

| 2013-05-02 | 389.43 | 499.25 | 普通 |

| 2013-04-15 | 407.55 | 499.25 | 普通 |

| 2013-04-01 | 392.18 | 499.25 | 普通 |

| 2013-03-18 | 402.62 | 499.25 | 普通 |

| 2013-03-04 | 407.22 | 499.25 | 普通 |

| 2013-02-18 | 405.56 | 499.25 | 普通 |

| 2013-02-01 | 419.54 | 499.25 | 普通 |

| 2013-01-18 | 438.71 | 499.25 | 普通 |

| 2013-01-04 | 478.21 | 499.25 | 普通 |

| 2012-12-19 | 509.44 | 499.25 | 普通 |

| 2012-12-05 | 1223.9 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2012-11-21 | 1210.3 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2012-11-07 | 484.71 | 499.25 | 普通 |

| 2012-10-24 | 487.07 | 499.25 | 普通 |

| 2012-10-10 | 482.37 | 499.25 | 普通 |

| 2012-09-26 | 1221.41 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2012-09-12 | 477.29 | 499.25 | 普通 |

| 2012-08-29 | 1168.98 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2012-08-15 | 468.34 | 499.25 | 普通 |

| 2012-08-01 | 1200.6 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2012-07-18 | 1185.16 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2012-07-04 | 487.55 | 499.25 | 普通 |

| 2012-06-20 | 494.8 | 499.25 | 普通 |

| 2012-06-06 | 516.82 | 499.25 | 普通 |

| 2012-05-23 | 514.16 | 499.25 | 普通 |

| 2012-05-09 | 510.48 | 499.25 | 普通 |

| 2012-04-25 | 525.53 | 499.25 | 普通 |

| 2012-04-11 | 1263.92 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2012-03-28 | 1284.24 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2012-03-14 | 1241.66 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2012-02-29 | 1255.97 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2012-02-15 | 1292.56 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2012-02-01 | 2261.61 | 1997.00 | -40%<(指数-均线)/指数<-30% |

| 2012-01-18 | 2298.04 | 1997.00 | -40%<(指数-均线)/指数<-30% |

| 2012-01-04 | 2228.79 | 1997.00 | -40%<(指数-均线)/指数<-30% |

| 2011-12-20 | 1579.91 | 1497.75 | -30%<(指数-均线)/指数<-20% |

| 2011-12-06 | 1529.88 | 1497.75 | -30%<(指数-均线)/指数<-20% |

| 2011-11-22 | 1212.75 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2011-11-08 | 1199.4 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2011-10-25 | 1561.78 | 1497.75 | -30%<(指数-均线)/指数<-20% |

| 2011-10-11 | 1584.92 | 1497.75 | -30%<(指数-均线)/指数<-20% |

| 2011-09-27 | 1220.16 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2011-09-13 | 1183.99 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2011-08-30 | 475.48 | 499.25 | 普通 |

| 2011-08-16 | 468.34 | 499.25 | 普通 |

| 2011-08-02 | 467.46 | 499.25 | 普通 |

| 2011-07-19 | 452.63 | 499.25 | 普通 |

| 2011-07-05 | 458.03 | 499.25 | 普通 |

| 2011-06-21 | 1164.43 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2011-06-07 | 472.77 | 499.25 | 普通 |

| 2011-05-24 | 472.77 | 499.25 | 普通 |

| 2011-05-10 | 460.56 | 499.25 | 普通 |

| 2011-04-26 | 456.77 | 499.25 | 普通 |

| 2011-04-12 | 456.35 | 499.25 | 普通 |

| 2011-03-29 | 450.99 | 499.25 | 普通 |

| 2011-03-15 | 448.56 | 499.25 | 普通 |

| 2011-03-01 | 441.42 | 499.25 | 普通 |

| 2011-02-15 | 454.28 | 499.25 | 普通 |

| 2011-02-01 | 471.88 | 499.25 | 普通 |

| 2011-01-18 | 468.78 | 499.25 | 普通 |

| 2011-01-04 | 426.71 | 499.25 | 普通 |

| 2010-12-20 | 413.29 | 499.25 | 普通 |

| 2010-12-06 | 426.35 | 499.25 | 普通 |

| 2010-11-22 | 408.22 | 499.25 | 普通 |

| 2010-11-08 | 396.86 | 499.25 | 普通 |

| 2010-10-25 | 419.89 | 499.25 | 普通 |

| 2010-10-11 | 452.63 | 499.25 | 普通 |

| 2010-09-27 | 456.35 | 499.25 | 普通 |

| 2010-09-10 | 466.59 | 499.25 | 普通 |

| 2010-08-27 | 497.26 | 499.25 | 普通 |

| 2010-08-13 | 504.29 | 499.25 | 普通 |

| 2010-07-30 | 508.92 | 499.25 | 普通 |

| 2010-07-16 | 1233.99 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2010-07-02 | 1236.53 | 1198.20 | -20%<(指数-均线)/指数<-10% |

| 2010-06-18 | 505.83 | 499.25 | 普通 |

| 2010-06-04 | 502.26 | 499.25 | 普通 |

| 2010-05-21 | 501.26 | 499.25 | 普通 |

| 2010-05-05 | 499.25 | 499.25 | 普通 |

[1] 金额不包括手续费

收益率(按年计)

| 年份 | (年末净值相对于年初净值的)收益 | 深证综指收益 |

|---|---|---|

| 2010 | 15.00% | 7.68% |

| 2011 | -22.14% | -33.91% |

| 2012 | 19.42% | 4.44% |

| 2013 | 41.86% | 20.50% |

| 2014 | 26.40% | 32.50% |

| 2015 | 108.56% | 60.69% |

| 2016 | -10.72% | -7.08% |

| 2017 | 19.33% | -2.69% |

同类优秀基金收益

三年期两种定投方法收益对比

| 名称 | 普通定投收益 | 均线+基金市值的智能定投收益 | 两种定投收益率之差 |

|---|---|---|---|

| 申万菱信深证成指分级进取 | 46.23% | 77.48% | 31.25% |

| 中邮战略新兴产业 | 164.38% | 174.00% | 9.62% |

| 泰达中证500进取 | 100.83% | 166.67% | 65.84% |

| 汇添富民营活力 | 114.75% | 146.77% | 32.02% |

| 长信量化先锋 | 117.06% | 141.17% | 24.11% |

| 富国中证军工指数分级B | 58.48% | 138.82% | 80.34% |

| 信诚中证500B | 13.58% | 136.76% | 123.18% |

| 华安逆向策略混合 | 131.51% | 136.33% | 4.82% |

| 大摩多因子策略 | 98.62% | 136.29% | 37.67% |

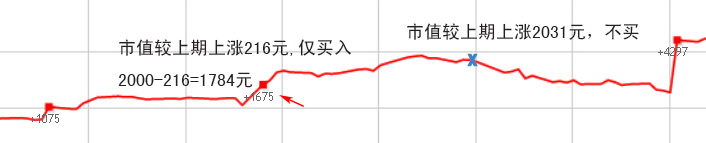

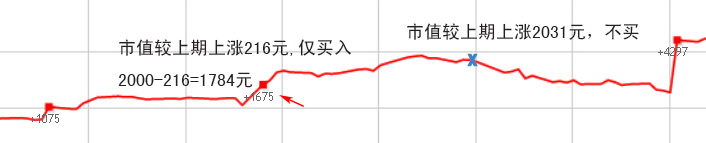

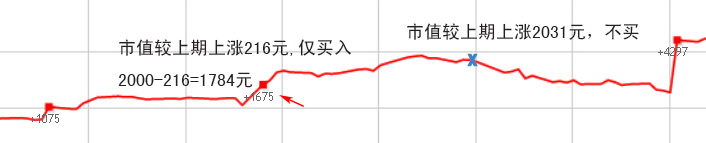

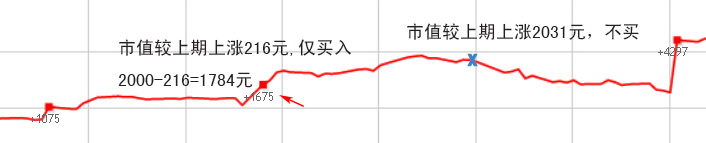

账户的基金市值每期增加固定金额,如增加2000元,当基金市值较上一期上涨1500元,则只要再买入500元;当市值较上一期下跌500元时,则需要买入2500元。上涨得越多,买的越少,下跌的越多,买的越多。逆向操作。

投资时间越久,或者市场波动越大,很可能需要大额买入。适合风险偏好高的用户

每期增加的市值也可以逐渐增加,例如每期增加1%: 2000, 2020, 2040.2, 2060.60,...,

投资时间越久,或者市场波动越大,很可能需要大额买入。适合风险偏好高的用户

每期增加的市值也可以逐渐增加,例如每期增加1%: 2000, 2020, 2040.2, 2060.60,...,

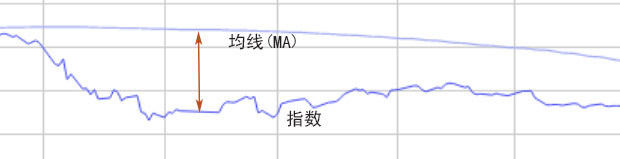

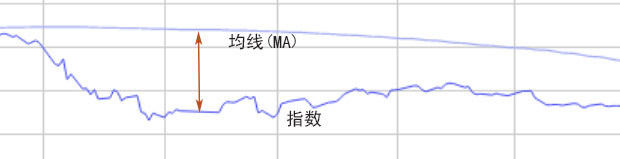

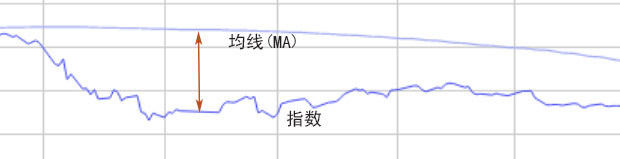

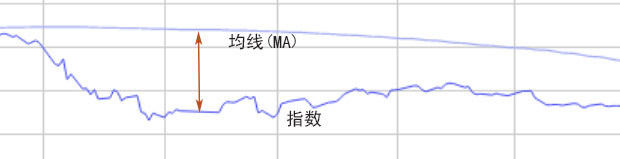

均线(MA)是指过去N天指数的平均值,类似指数的平滑曲线,反映了中长期的趋势。指数比均线低时,越低越买;净值上涨很高时,果断卖;当指数比均线高5%+,表示(指数-均线)/指数>5%

在定投日检测以下市场指标,来确定买卖的金额.

当市场条件满足多个计划时,只会执行优先级最高的计划。优先级是:净值>均线>市盈率>盈亏>波动率>市值;

同时不再执行上方每期定投了,除非勾选每期必投

同时不再执行上方每期定投了,除非勾选每期必投

当日净值与N天之前的净值比较,比率=当日净值/N天前的净值-1。在定投日当净值的比率符合设定的条件,就会执行设定的买卖金额。

账户的基金市值每期增加固定金额,如增加2000元,当基金市值较上一期上涨1500元,则只要再买入500元;当基金较上一期下跌500元时,则需要买入2500元.

每期增加的市值也可以逐渐增加,例如每期增加1%: 2000, 2020, 2040.2, 2060.60,...

每期增加的市值也可以逐渐增加,例如每期增加1%: 2000, 2020, 2040.2, 2060.60,...

当净值的选项和上证指数的选项同时有效时,上证指数的选项优先。

不勾选时,当智能条件成立,只会执行智能选项的买卖规则;

勾选时,每期必须投入固定金额,若智能条件成立,两者叠加执行。

勾选时,每期必须投入固定金额,若智能条件成立,两者叠加执行。

当为1%时,每期固定投入的金额会增加1%,相当于克服通胀的影响,每期投入金额会是:1000,1010,1020.1,...

市值是指:现有基金市值加上其他指标触发的卖出金额,例如,净值指标触发卖出1000元,那么持仓市值就会减少1000元,下一期如果不计入这1000元,就会补仓买入1000元,那其他指标就失去了意义。因此在市值指标的计算中,需要计入其他指标的卖出金额。

例如每期市值增加2000元,下跌时,买入2倍,是指:当基金下跌时,按照原有价值计划要买入2200元,不过此时买入2000+(2200-2000)*2=2400元;将多买入的金额放大2倍。

上涨时,买入2倍,是指:当基金上涨时,按照原有价值计划要买入1800元,不过此时买入2000+(1800-2000)*2=1600元;将少买入的金额放大2倍。

卖出金额会计入收益率的计算中。

收益率的计算不计入卖出金额。

当卖出次数比较多时,推荐使用这个公式,摊平成本。

统计过去一年以来,基金和指数的每天的涨跌幅度,从这个特征出发,找出与基金最相似的指数。

均线(MA)是指过去N天指数的平均值,类似指数的平滑曲线,反映了中长期的趋势。指数比均线低时,越低越买;净值上涨很高时,果断卖;当指数比均线高5%+,表示(指数-均线)/指数>5%

在每个定投日,检测以下设定的智能条件,例如是否净值高于2.1,是否均线高于指数5%,如果条件成立,就执行对应的交易金额,例如净值高于2.1,买入1200元。如果设定的智能条件都不成立,就买入最下方设定的普通定投金额。

智能条件有优先级,净值的优先级最高,市值的优先级最低。如果各种指标都成立,则优先买卖净值设定的金额。

智能条件有优先级,净值的优先级最高,市值的优先级最低。如果各种指标都成立,则优先买卖净值设定的金额。

IRR,所有现金流折现到期初。总收益率=(1+年化收益率)的(250/间隔天数)次方 -1

年化收益率考虑了资金占用的时间长短。时间越短,年化收益率越高。因此,当有相当长一段时间内清仓卖光了,不持有基金,就有可能使得年化收益率比收益率要高。可以简单的认为,年化收益率约等于收益率除以资金占用时间。